By Peter Standring, technical secretary at Industrial Metalforming Technologies

All forms of transport require a source of power. Manual and wind for early ships; draught animals and horses on land; steam engines powered by coal gave way to oil. Then, independently on the same day in 1886, two German engineers, Benz and Daimler, both filed patents for petrol driven engines.

Interestingly, in 1903, Charlie Taylor, who worked for the USA-based Wright Brothers, produced a new lightweight 9kW (12 Hp) gasoline engine for the world’s first flying machine because no suitable automotive engine could be found. This had a four cylinder cast aluminium block and weighed 32kg.

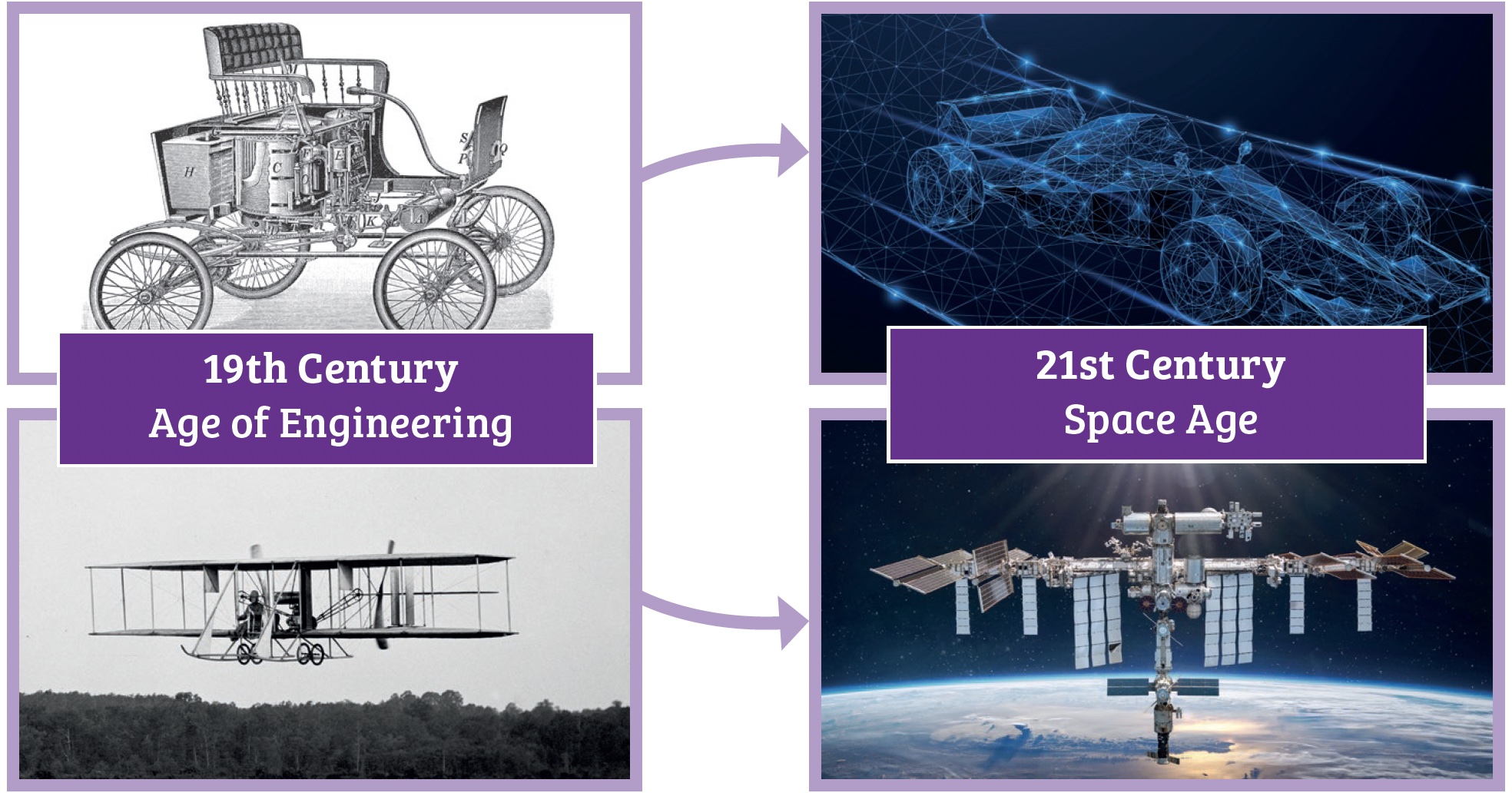

Figure One gives an appreciation of how technical developments in automotive and aerospace industries have progressed in the intervening hundred plus years.

It is interesting to observe how those working in the automotive and aerospace industries consider each other. In automotive, high volumes and small profit margins naturally promote a ‘get it done now’ Just in Time (JIT) philosophy. Contrast that with the rarefied atmosphere of aerospace, which is often expressed in the offhand and entirely true statement, regarding safety: ‘That there is no hard shoulder at 10,000 metres!’

In some respects, this is a strange argument. Within all major automotive companies today, the sharing of platforms and componentry across models to achieve cost reductions through increased volume is essential if they are to remain viable. This means that any warranty failure of a component or assembly could easily involve a million recalls. Where these are safety critical, the cost to the OEM both financially and reputationally could be just as damaging as any major aircraft incident.

Also, the aerospace and automotive industries have had a long and symbiotic relationship. For example, in WW2 it was the automotive industry that governments called on to increase the output of aircraft, which existing aerospace OEMs were simply unable to do. This proved to be hugely successful and through the introduction of standardisation, etc, quality was also improved.

Figure One prompts two other thoughts about how the two industries have developed. In the first, the volume space available for the aerospace industry to use extends from ground/sea level literally out into space. For land based wheeled/tracked means of transport, only 30% of the earth is not water and of that, only a tiny fraction includes a road transport network.

The second consideration from Figure One, is that all ground transport must operate in two dimensions. All aircraft plus their attendant development, e.g rockets, satellites, missiles, telecommunications, etc, operate in three dimensional space and are therefore free to exploit the cosmos.

Unintended consequences

As I stated in the September 2022 issue of Fastener + Fixing Magazine entitled: ‘A supply chain message – will wearing blinkers lead to myopia and how could this impact the fastener industry?’ if there is a choice between ‘stability’ and ‘growth’, the manufacturing industry will always prioritise stability.

A classic example was the collapse of the Soviet Union in 1989 and three months earlier, the crushing of the Chinese student protests in Tiananmen Square. These two actions in different ways, introduced thirty years of peaceful development within Europe and also with China.

The consequences of these actions, were the almost immediate and drastic reduction in defence spending within the USA and elsewhere. In 1988, the percentage of US Department of Defence (DoD) spending within the US aerospace industry was 64.2%, which by 1997 had dropped to 38.6%. Over this period, large scale ‘mothballed’ facilities kept available for future military use by the major OEMs were scrapped. To off-set this, the switch to civil build was also dramatically increased from 27.5% in 1988 to 50% in 1997 to match the subsequent growth in air traffic. These were unintended but mostly welcome consequences.

Throughout the 1990s and 2000s, the growth in air passenger travel boomed with budget airlines particularly offering seats often at ‘give away’ prices. Air cargo also boomed with the development of online business and shipping. At the top of the pile, the major battle between Airbus and Boeing was whether single aisle (Dreamliners) or jumbo (A380s) would capture the growing international market. In this competition, efficiencies were measured by reduced operating costs against price per passenger.

The astonishingly rapid development of China as a primary manufacturing base saw major aerospace supply chain partners finding their own Chinese suppliers. These links often began with the customer having their own ‘expert’ staff embedded within the Chinese suppliers’ premises to ensure that the necessary procedures and quality standards were met. The knowledge transfer and creation of local sub supply chains established fully accredited facilities and provided opportunities for the Chinese companies to gain their own international reputation. As this author was told by a European manager working for a major OEM at their joint venture facilities in China: “We have spent 100 years developing this technology and have just given it all away.”

Current instabilities

In 2019 there were 4.56 billion passengers travelling by air. In 2020, this was down to 1.81 billion, a 60% reduction. This crash, due to the Covid-19 pandemic, literally brought the aerospace industry to its knees with many aircraft being converted to carry cargo to keep them flying.

Unlike in 1989, when military spending rapidly switched to the civil sector, in 2020, with the virtual shutdown (and without any end point in sight) it was the demand for military, science and telecommunications sectors that kept the manufacturing side of the aerospace business going.

With little evidence of Covid-19 disappearing and no means of dealing with it globally, the spectre of further lockdowns remain constantly just over the horizon.

Introduce a totally unnecessary full scale European war; a global energy and food crisis; coupled with the enormous, inflated expenditure this involves and, quite simply, it removes any opportunity to return to a stable form of life. Clearly, those in the ‘defence’ industries will enjoy a boom in their business but the knock on for the future will inevitably mean fewer resources will be available for normal business activities.

The players

What is perhaps surprising is, given air transport provided an affordable means to shrink the world, that the country having the largest land mass has never been considered at the forefront of aerospace development. Of course, the former USSR did launch the World’s first satellite and achieve the first manned flight in space. However, despite having total control of the state’s entire resources, in the aerospace race, Russia has always been behind and trying to catch up. In the USA, where the continental development of air transport for commercial purposes was just as appealing as in Russia, aerospace OEMs boomed.

Today, economic rationalisation has created two competitive giant companies. Boeing in the USA and Airbus in Europe. There are also a series of other leading edge smaller manufacturers based in the USA, Europe and elsewhere. These are complimented by a host of major aerospace spin-off sectors including space systems, satellites, communications, radar/electronics, air traffic control, etc. In total, a huge and ever-growing aerospace umbrella under and within which exists a fully supportive and well rehearsed supply chain, which includes all the fasteners required to hold everything else together.

The market

In any turbulent market, until stability returns, it always challenges the crystal ball to provide any meaningful data. Since some parts of the world still remain subject to Covid-19 regulations, it is uncertain how quickly genuine growth will return.

The USA production figures for 2019 – 2020 are interesting in that they reveal a 75% fall off for wide body and a 50% for narrow bodied aircraft. This may reflect the need for manufacturers to clear the backlog of order schedules following lockdown or a trend which was anticipated pre Covid-19?

On the defence side, in the USA, fixed price contracts require contractors to cover unexpected costs, as well as those due to inflation. Given the recent rise in inflation the DoD have extended a helping hand on inflation to the Tier One contractor, all others will have to deal with extra costs on their own.

Major areas for potential growth of the aerospace industry exist in drone technology (commercial and military); componentry for all flying and ground based facilities; new methods of design and efficient manufacture; application and exploitation of new materials e.g (graphene, nano tubes); new power sources (electric, hydrogen); advanced aerial mobility (AAM), hypersonic, missiles and space. It is of considerable interest to note that three of the main ‘private’ long-term ventures into ‘space’ are funded by three very rich individuals based in the USA.

Advantages and threats for aerospace fastener manufacture

Despite the huge progress made in aerospace, as shown in Figure One, the absolute requirement for safety first ensures that once established, a successful solution is accepted and thereafter, practically fixed in stone. Anything new or different requires complete evaluation, documentation and accreditation before it can be adopted. This is not a surprise when considering a component or methodology may be used in an aircraft design over many decades.

The final Boeing 747 aircraft was produced in December 2022 ending a production run of 1,574 aircraft begun in 1967. The Airbus A380 was also originally slated to have a similar life span but unless passenger air travel preferences change, this is unlikely to be the case.

And for the fastener industry?

It is clear and evident that nothing can be realistically forecast until stability returns to the world of business. When will Covid-19 and any other global medical threat be manageable? When will political sanity be restored? When will energy and food supplies be taken off the inflation index? When will investment be considered as a natural part of growth rather than mere speculation?

The cycle of uncertainty regarding air transport needs to be broken. Passengers and freight must be provided with regular schedules and reliable flights. Without this, operators cannot determine demand for aircraft, services, etc.

For most fastener manufacturers there will have been many sleepless nights. Military is good, civil is not so. But for all, the cost and availability of material supply, pressures on production and uncertainty of demand are unlikely to be resolved soon.

For the OEM not involved with military contracts, the squeeze from investors, customers, a financially weakened supply chain, and the uncertainty of taking on commitments for future work, must be very worrying (particularly since overspent governments are increasingly reluctant to underwrite future bail out expenditure).

On the technical side, aerospace fastener manufacturers face both opportunities and threats. For example, in the rapid expansion of Advanced Aerial Mobility, particularly in the commercial and military use of drones and unmanned aerial vehicles (UAVs). These are predicted to fulfil passenger and cargo transportation in urban and rural areas operating from local vertiports. The adoption, application and expansion of these autonomous systems is predicted to become the global growth area for aviation in the immediate future. Of course, the size, materials used, and methods of manufacture of AAM systems, are likely to involve the use of non-traditional methods of fastening. However, given the often non-human involvement in the operation of these systems and their need to fly over space occupied by humans, the airworthiness and safety factors in their use will be guaranteed by stringent regulation.

A direct result of the Covid-19 crisis has been the lay-up and probable scrapping of large numbers of aircraft previously considered industry workhorses. When growth returns, these will be replaced by more efficient to use and modern types.

At the turn of this century, some countries (particularly in the Far East) sought to enter the aircraft industry by focussing on the areas of maintenance and repair. Such hubs offered major OEMs and aircraft users on-site facilities without the need to have aircraft return to their home base for such services. Clearly, with more aircraft taken out of service and newer, better designed, aircraft scheduled to take their place, maintenance and repair facilities will be required to restock the parts stores on possible reducing demand. For fastener manufactures and distributors supplying this area it could be a double-edged sword. Fewer older aircraft will mean an unwanted glut of parts for which there will be little demand, whilst new aircraft models could provide much appreciated additional orders.

The reckoning

When the history of 2020 is written and the evidence shows how things have changed, like any sunken ship, the wreckage will provide a new habitat for many life forms. The number of successful ‘take ups’ will depend on the environment, the nearby food chain, the opportunities for growth and the threats to survival.

For those already serving the aerospace fastener market, keep up the accreditation and quality standards to stay in the business. Most importantly be aware of the global changes, which will inevitably result from what has and is still taking place to disturb the natural order.

Demand, skills and products will change as they always do, only this time it will all happen at a much faster pace. Save what you can, change/modify what you must and be aware of and develop what you need to stay attractively competitive to all supply chain partners. As those companies that can’t change drop out, the demand to work with those who can will dramatically increase along with the attendant reputational and financial success.

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.