Continued global over capacity and depressed demand kept the lid tightly clamped on steel costs in 2019, despite some ructions in the iron ore supply chain. By contrast, nickel rattled through the year like a roller coaster ride.

Word of a, albeit partial, January US-China trade deal offered hope for global demand recovery but, just a few days into the new decade, President Trump once again demonstrated that, under his aegis, all bets are off in relation to global stability and the predictability of raw material trends.

In the first eleven months of 2019 global crude steel output increased by 2.7%. Drill down into the World Steel Association’s regional analysis1, however, and it is immediately clear that China was responsible for most of that growth, as its output continued to increase at +7% year-on-year to 904 million tonnes.

Vietnam was the only other Asian economy to show steel output growth and, as the US imposition of anti-dumping tariffs of more than 456% in December demonstrated, that related to US importers switching manufactured goods demand away from tariff-ridden China, most likely exacerbated by Chinese circumvention activity via Vietnam.

United States’ tariffs did result in something of a boost for steel, with output up +1.9% but substantial output declines in Mexico and Canada suggest tariff impacts were short rather than long range. Growth in the Middle East region was primarily attributable to Iran (+5.3% to 23.6 Mt). EU steel output fell -4.2% with only Austria (+10.9%) and Sweden (+2.2%) registering growth. In the rest of Europe, substantial percentage but limited volume growth in Norway and Bosnia and Herzegovina was more than offset by a -10% decline in Turkish output.

As WorldSteel reported in October, other than in China, “steel demand slowed in 2019 as uncertainty, trade tensions and geopolitical issues weighed on investment and trade. Manufacturing, particularly the automotive industry, has performed poorly contracting in many countries, however in construction, despite some slowing, a positive momentum has been maintained”.

Steel production costs, however, were far from flat during 2019. Opening the year at well below US$80/tonne the cost of high grade iron ore to Chinese ports escalated to above US$120/tonne in July. This was in consequence of the Brumadinho mine dam disaster, which killed at least 248 people, and subsequently severely restricted Vale’s iron ore output.

Global supply was further hampered by bad weather restricting Australian ore output. By autumn, ore prices had subsided to a still relatively strong US$80/tonne, rising again in December. As January opens they nudged closer to US$100/tonne as government environmental control restrictions on Chinese steel mills eased and Chinese New Year approached. That puts current ore cost around +28% compared with the end of 2018.

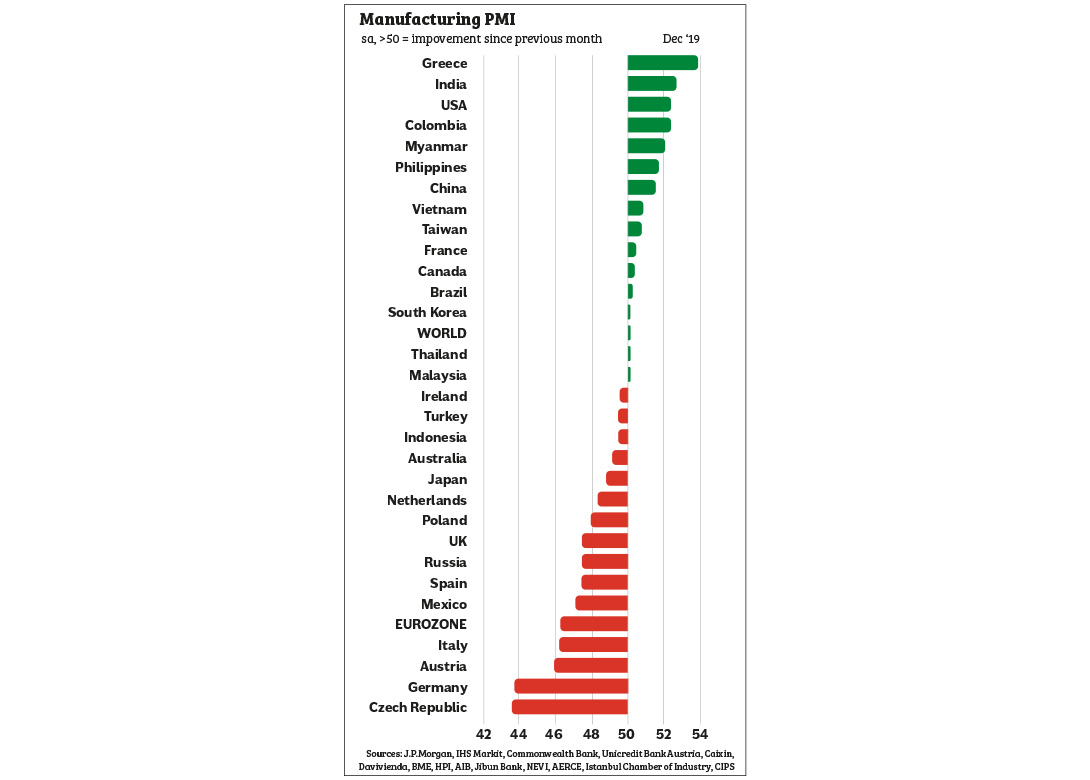

China’s domestic steel demand appears positive as 2020 is the last year of the current five year plan, placing pressure on the completion of infrastructure projects. As the Caixin December PMI indicates (previous page), Chinese manufacturing also shows some signs of general recovery. However, recovery in export demand depends on the first phase trade agreement with the United States being confirmed in January, and more critically, a reversal of the economic declines in most of Europe, as well as Japan and Russia. That now looks precarious in the aftermath of the United States fatal drone strike on Iran’s Major-General Qassem Soleimani.

Steel wire costs for the fastener industry remained subdued during 2019, with steel producer margins forced to absorb cost increases in the face of lacklustre demand. December’s Deutscher Schraubenverband raw material analysis2 shows wire rod costs for fastener manufacturers effectively flat from 2018 into 2019, then notching downwards from mid-year.

In Taiwan, China Steel Corporation held bar and rod prices during the first half 2019, reducing them by around €32/tonne in Quarter 3, then holding in Quarter 4, before announcing a similar reduction for the first quarter 2020. However, Yieh Hsing Enterprise Co Ltd, another Taiwanese wire rod manufacturer, demonstrated that higher raw material costs were biting into margins by announcing an increase of around €16/tonne for January.

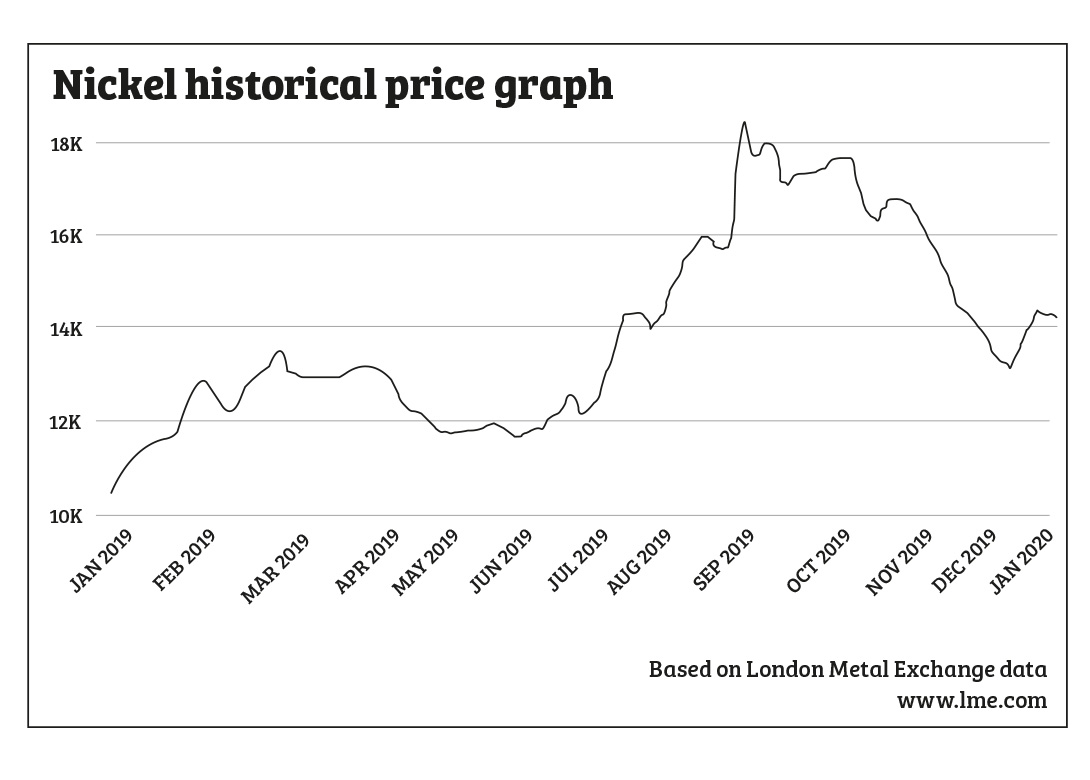

Steel might have been flat during 2019 but nickel had a far livelier year. The London Metal Exchange 3-month price opened 2019 at around US$10,500/tonne. By mid-July it stood at around US$14,000/tonne – up a third on the start of the year. It would have been reasonable, given nickel inventories were increasing and US tariffs on China were softening stainless steel demand, to expect the market to have turned bearish in the second half of the year.

However, things started to happen in Indonesia, the world’s largest producer of nickel ore. Concerns over widespread flooding in the Sulawesi mining region offset downward market pressure – although the actual impact on production proved limited. Signs that US-China trade relations might improve boosted market confidence but were short-lived.

Then rumours circulated that Indonesia would bring forward a previously announced deadline to restrict exports of unprocessed nickel ore from 2022. Indonesia obfuscated but LME prices still drove to around US$15,500/tonne by mid-August. Reported sharp growth in Chinese stainless steel output strengthened market sentiment.

At the beginning of September, Indonesia came clean, confirming it would ban exports of all grades of nickel ore from January 2020 regardless of existing contracts. LME prices spiked to above US$18,000/tonne but President Trump’s announcement of a new round of import tariffs on Chinese manufactured goods soon cast doubts on stainless steel demand. At the end of October, Indonesia briefly suspended all nickel ore exports without notice to fend off a pre-deadline demand rush. The announcement temporarily arrested declining nickel prices, to hold around US$16,500/tonne. By the end of the year LME nickel had subsided to around US$14,000/tonne – still 33% up in the year – and is currently hovering around that level. Short-term stability looks to be founded on a better understanding of what Indonesia is doing in terms of forcing domestic downstream processing of ore and signals from the Philippines, the second largest producer to global nickel supply, that it would increase ore output.

LME nickel inventories have also substantially recovered, having plunged to record lows, apparently as Chinese stainless steel producers stockpiled against the Indonesia ban. The European Union has initiated WTO processes in protest at Indonesia’s actions. However, with the WTO dispute body effectively neutered through the lack of US support this seems unlikely to influence the market.

What the second half of 2019 ably demonstrates is just how reactive the nickel market is to short term factors rather than the fundamental supply and demand curves. Speculation about the impact of demand for nickel for electric vehicle batteries has also occasionally had some influence. The reality, however, remains that more than 70% of global nickel is consumed by the stainless steel industry, compared with less than 5% currently for batteries.

While it is clear that the nickel content in EV batteries is increasing as manufacturers seek to increase effective vehicle range, and EV sales are increasing, the demand growth curve remains modest. Range and cost clearly remain issues for consumers; more significant as an inhibitor to growth, at least for the present, is the availability of charging points. The European vehicle maker association, ACEA, recently issued a report3 illustrating the scale of infrastructure challenge in progressing from the present 150,000 charging points in Europe to the 2.8 million it requires by 2030 to meet demanding new emissions standards.

One footnote, particularly in relation to stainless steel fasteners. The economic downturn, particularly in Europe, and the stop-go BREXIT deadline have resulted in high fastener supply chain inventory levels, which mean that the full effect of raw material inflation has not washed through to the market. Even if market uncertainty prevails, as seems probable as this report is written, there is a pent-up material driven inflationary pressure on fastener pricing.

1. https://www.worldsteel.org/en/dam/jcr:8fa70871-4c62-49f0-a1c9-96b004e02773/November%25202019%2520Crude%2520Steel%2520Production%2520Table.pdf

2. https://www.schraubenverband.de

3. https://www.acea.be/publications/article/making-the-transition-to-zero-emission-mobility-2019-progress-report

Having held senior management roles in leading automotive and fastener businesses, Phil joined Fastener + Fixing Magazine as editor in 2002. Convinced there is no substitute for ‘being there’, over 17 years of visits and interviews around the world means he has accumulated an extraordinary knowledge and perspective of the global fastener industry, reflected in his incisive and thought provoking reporting.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.