By Marek Łangalis, owner of Olfor

The fastener industry in Poland has experienced the most impressive decade in its history. Since 2009 production has doubled and export has almost tripled. For the fastener market it is currently the fastest growing market in Europe, with good prospects over the next few years.

Polish economy

The economy in Poland has very stable foundations. After the bankruptcy of communism in 1989, with a centrally controlled economy and over 90% of the state’s share in generating GDP, hard working Poles have taken life into their own hands. Poland’s GDP has grown every year since 1992 with a yearly average of 4.1% (4.7% in 2017). Politicians in Poland argue over many irrelevant matters, but when it comes to the economy the social democrats, liberals, and conservatives, all agree that Poland needs a strong, open, and free market.

Previously many of the industrial factories within Poland were state owned, but year by year they have been sold to foreign concerns, domestic entrepreneurs or through the stock exchange. Today the state is only represented in the energy and financial sector. The rest is in private hands. GDP per capita now is at the level of US$29,500 (€25,900), whereas in 1992 it was only US$6,000. Such a stunning success was achieved thanks to the huge entrepreneurship of millions of Poles. In a country where 16.5 million people work (out of 38 million of all inhabitants), 1.5 million active enterprises operate. The unemployment rate in 2004 (just after joining the European Union) was at 19.2% – the highest of all the OECD countries. Now it is one of the lowest – 3.4%. There are still a lot of economic problems in Poland, for example – salaries are at a low level compared to Germany, the UK or France (a monthly net average of €750 and a minimum net of €400) with of course a lower cost of living. However, year by year salaries are growing. Poland is now the 3rd best country to invest in the world (ranking was based on the scores by 6,000 business decisions makers). It is very important to understand where Poland is at this moment. Before World War II the Polish economy was at the level of Spain and Italy and within the next 15 years it should be somewhere beside these countries again.

Fasteners and industry

Production of fasteners can develop in three ways: With export (like in Taiwan), with domestic industry (like in Turkey) or with export and domestic industry (like in China). At this moment Polish fastener businesses are focused on the demand of the domestic industry rather than export. Industry in Poland is responsible for creating 40% of the GDP (in Germany – 30%) and 30.5% of jobs. Southern Poland is more industrialised than the northern part with the largest concentration of factories in the Upper Silesian region (the second most industrialised region in Europe, behind the Ruhr District in Germany). According to a Deloitte report, Polish industry is the second most competitive in Europe, after Germany. The most important advantage of Poland over other countries is access to talented and qualified employees (with much lower salaries than in western European countries). It should be added that for many young and talented people, work in industry is a big ennoblement. It is more honourable to work in industry than in finance (even though the current Polish Prime Minister Mateusz Morawiecki was CEO of the 3rd biggest bank in Poland for more than 8 years).

From the point of view of using fasteners, the most important industries are furniture, automotive, aerospace, domestic appliance and construction. Poland is the 4th largest furniture exporter in the world (yearly more than €12 billion). There are 22,000 companies producing for the furniture market in Poland, most of them small and medium ones. 85% of the total production is going for export. Big brands (such as IKEA) have also opened their factories in Poland. It is not only the furniture sector that has experienced good growth, the Polish window and door industry (including plastic and aluminium windows) is at the top position in the European Union with an export value of €1.8 billion. What is even more important is that the furniture, doors and windows are being produced all over Poland, in every region.

Poland does not have its own brand (such as Skoda in the Czech Republic) for the automotive passenger car, but there are two OEM automotive factories: Fiat (Fiat Chrysler Automobiles) and Opel (former General Motors, now PSA Group). Production in Poland of cars was 515,000 units in 2017. There are also a lot of tier one and tier two factories for the automotive sector, including Toyota Motor, Valeo, Faurecia, Delphi, and Kirchoff. All the automotive industry is based in the south of Poland, from Kraków on the east to Upper Silesia and Lower Silesia on the west. There are also OEM factories for the light commercial vehicle and trucks division (such as Volkswagen and MAN). However, most impressive is the bus production – 5,300 units produced makes Poland the 3rd biggest producer in the European Union (after Germany and Sweden). Many brands, like MAN, Volvo, Neoplan, and Scania, have their factories in Poland. There is also the Polish brand – Solaris, which has produced more than 1,500 units and has just been acquired by Spanish train producer – CAF.

Aerospace is one of the fastest growing industries in Poland. With more than 100 production companies (with 23,000 employees) 90% of the aerospace potential is based in Aviation Valley, south-east Poland. Aerospace industry exports generate more than €2 billion. The most recognisable brands that operates in Poland are Sikorsky, AgustaWestland and Airbus Military. The aerospace industry in Poland is connected mainly to military expenditures.

The construction industry is another very large consumer of fasteners. The investment boom has been taking place in Poland for over ten years. New airports and football stadiums have been built all over the country. For new roads the Polish government wants to invest more than €40 billion up to 2023 and €10 billion for the railways until 2021. Due to air passenger numbers growing by more than 20% year to year the government also wants to build a new central airport near Warsaw at the cost of €10 billion (with a new railway station and whole road infrastructure) for almost 100 million passengers.

Last but not least – electronics and domestic appliances. With the production value of more than €16 billion these sectors are a big consumer of fasteners. In Poland there is a huge range of factories for cookers, washing machines and refrigerators, such as Bosch, Siemens, Samsung, Whirlpool, Electrolux, LG, Zelmer (domestic brand) and the biggest factory – Polish Amica. Within electronics there is Dell, LG, Flextronics and Sharp.

The array of big factories within Poland shows that until now fastener businesses have been more dedicated to domestic growth of industry.

Fastener market

The Polish fastener market is still developing and there is a lot of space for new business. In the market there are approximately 1,500 entities operating – from small regional metalshops through to fastener wholesalers and distributors up to the big producers. As in every European country fastener businesses are predominately small and medium sized companies. The biggest on the Polish market is Rawlplug (former Koelner) with turnover (in 2017) of more than PLN 700 million1. But it is hard to compare Rawlplug turnover to other competitors, because a big part of the sales comes from tools, not from fasteners. However, Rawlplug is still a big producer and exporter of bolts, nuts and anchors. The majority of other companies have turnovers of less than PLN 300 million. A lot of Polish producers also have distribution branches based on the knowledge of the employees regarding bolts, nuts and washers. Because of the big potential of the Polish market, a lot of European brands have opened their own or bought local distributors.

Fastener production

Production of fasteners in Poland in 2003 was at the level of PLN 595 million. The very important date for Polish market was 2004 – Poland became a member of European Union – so all the current members had to open their market for the Polish products. Fasteners that year saw a growth of more than 33%. Till 2008 production growth was very dynamic. In 2009 Poland suffered from the global financial crisis. It was also a very important date because the EU opened anti-dumping duties for a lot of fasteners made in China. This decision was a big opportunity for Polish producers and within the next two years they had almost doubled the production to fulfil demand from the European market. The next five years (2012 – 2016) was very hard for the production of fasteners in Poland. Too large production capacities forced a lot of companies to look for more profitable products, especially when the EU withdrew the anti-dumping duties in 2016. Despite this decision production of fasteners in Poland in 2017 was higher (6.6%) than in 2016 and achieved a record PLN 1.6 billion (around €380 million). In Poland there is now a good production of standard bolts and screws, stainless products, anchors, special products (good quality and fast delivery), rivets and fixings.

Table 1: Production of fasteners in Poland in 2003 – 2017

Source: Calculation based on the data of the Central Statistical Office (Statistics Poland)

Import of fasteners

The main source for the domestic demand of fasteners is imports. Poland still imports more than it produces and the difference is significant. Production of fasteners in Poland from 2003 to 2017 has grown by around 178% and import in that period has grown by around 200%, which shows imports are growing much faster than production. It depends on domestic demand and the role of the Polish market in the European fastener market. The biggest growth was between 2003 – 2008. It was a time when the Polish economy grew by an average 6%. Now it is more stable, but still Polish import is developing.

Table 2: Import of fasteners to Poland in 2003 – 2017

Source: Calculation based on the data of the Central Statistical Office (Statistics Poland)

The main source for Polish fastener companies is Germany. From 2010 this country is responsible for almost one third of all imports (see Table 3). A very important role is then taken by Taiwan and China but even together they send less fasteners to Poland than Germany. For the German companies it is very easy to operate on the Polish market. Sometimes they open an office in Poland, but even without it they can control the supply chain. The cost of transport from Germany to Poland is low, and a lot of German companies employ Polish language people. Until 2010 Italy was the 2nd most important sourcing partner for Poland, but the role of Italian companies year by year has decreased. Since 2010 imports from Taiwan grew 80%, from Italy 10% and from China 140% (from USA even 200%). Table 3 shows from which countries Poland is now buying fasteners.

Table 3: Import of fasteners by country to Poland in 2010 – 2017 (PLN million)

Source: Calculation based on the data of the Central Statistical Office (Statistics Poland) and Trade Competitiveness Map, Analyse country and product competitiveness with trade flows, International Trade Centre

Export of fasteners

The most impressive progress for fasteners in Poland was made by export. Since 2003 it has grown by 330%. Poland has taken the role of local leader – especially for the smaller countries in the region, but not only. Every year exports are growing, even in 2017 the dynamic of the growth was almost 10%. It is not only for the production ‘Made in Poland’, but also the big importers in Poland that have started to export globally.

Table 4: Export of fasteners from Poland in 2003 – 2017

Source: Calculation based on the data of the Central Statistical Office (Statistics Poland)

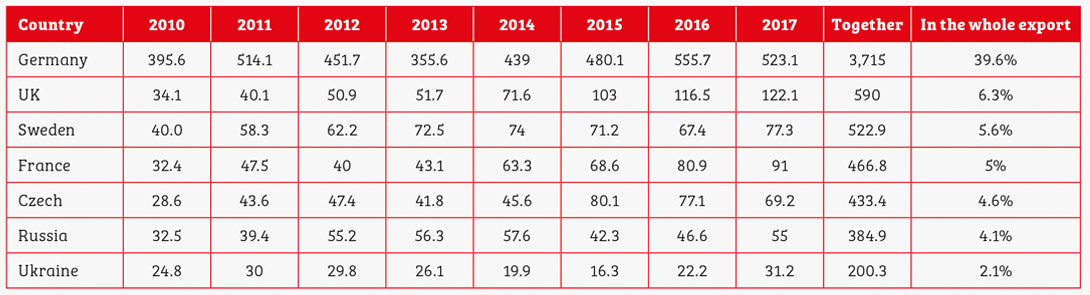

The same as for imports the biggest partner in exports for Poland is Germany with almost 40% of export. A lot of producers make special products for the German market. The 2nd biggest market (but with much better dynamic) is the United Kingdom. For the last seven years exports to the UK have grown by 280%. The company most responsible for that is the biggest Polish fastener producer and distributor Koelner, which bought Rawlplug. Good relations to the UK market is also made by more than a million Poles working there as constructors and builders. In addition to what you can see in Table 5, Poland is taking an important role for many smaller countries in the region. For the Ukraine, Poland is the 4th main source for fasteners, for Sweden it is also 4th, for Slovakia 8th, for Romania 6th, for Lithuania 4th, for Latvia 3rd. It is hard to sell to these countries for the big companies for example from Spain or France. That is why Poland has become a local leader and year by year export is growing. Polish companies have also set-up offices in Lithuania, Ukraine and Russia. Lots of Ukrainians working in Poland helps to sell to Russian language countries such as Russia, Ukraine and Belarus.

Table 5: Export of fasteners by country from Poland in 2010 – 2017 (PLN million)

Source: own calculation based on the data of the Central Statistical Office (Statistics Poland) and Trade Competitiveness Map, Analyse country and product competitiveness with trade flows, International Trade Centre

Conclusion

Fastener business in Poland will start to take a bigger role in European trade. Poland is already gaining on Spain and it will only be a matter of 3 – 4 years when production of fasteners in Poland will be higher. Domestic demand is growing, but Polish companies also are opening up to exports due to the low prices and low margins with the domestic market, as well as a lot of competition. Export will be the opportunity for the market to find the next possibilities for impressive growth.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.