By Thais Terzian, senior analyst, and Chris Bandmann, analyst, at CRU Group

Steel prices have surged during the post Covid-19 recovery as supply has struggled to keep up with demand. Prices for some products and markets hit all time highs in 2021 and detached from costs. However, the steel price cycle peak is now behind us – although upside risks are still live.

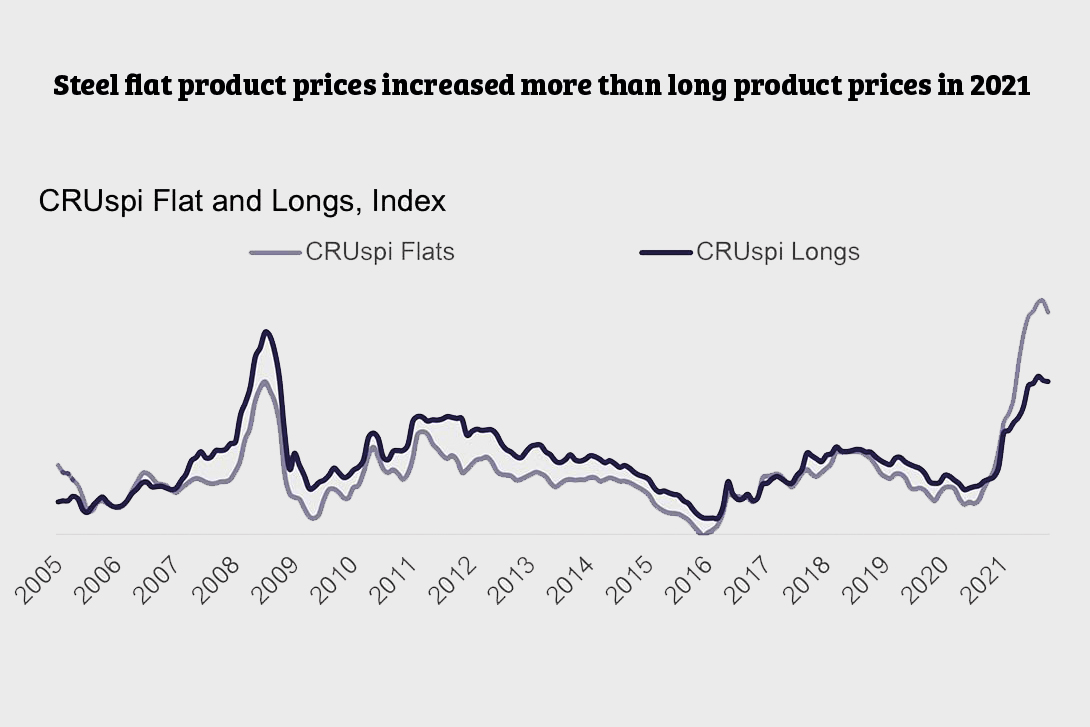

Wire rod – and steel long products in general – saw massive increases in 2021, to levels not seen since before the Global Financial Crisis (GFC) in 2008. Even so, the price rise for long products looks small compared to flat products.

Wire rod – and steel long products in general – saw massive increases in 2021, to levels not seen since before the Global Financial Crisis (GFC) in 2008. Even so, the price rise for long products looks small compared to flat products.

Why did prices rise so much?

Steel prices and long product prices have boomed since December 2020 as supply was insufficient to cover end use demand and supply chain restocking. Production of long products outside China was severely hit by the Covid-19 crisis and the recovery was gradual but was outpaced by the improvement in apparent demand.

In 2020 Q2, lockdowns and a sudden drop in end use demand led to supply cuts and longs production dropping by 20% quarter-on-quarter. The recovery started in the following quarter but took three quarters to approach 2019 H1 levels. In the meantime, restocking and pent-up demand added to recovering underlying demand and pushed the market into undersupply outside China.

The undersupply outside China was made worse by a strong economic stimulus in China, which totalled around 6% of GDP – the highest since the Global Financial Crisis. Part of the stimulus was invested in the construction and infrastructure sector. Longs demand in China was so strong that exports fell to a multi-year low by 2020 Q3.

economic stimulus in China, which totalled around 6% of GDP – the highest since the Global Financial Crisis. Part of the stimulus was invested in the construction and infrastructure sector. Longs demand in China was so strong that exports fell to a multi-year low by 2020 Q3.

Price pressure also came from costs

It isn’t just steel prices that increased. Global average scrap prices have increased significantly in 2021 due to tight supply and increasing demand from steel makers. Lower economic activity and strict social distancing measures in 2020, alongside severe weather conditions early in 2021, curbed scrap generation and collection. The resumption of idled steel mills and increasing production from others pushed demand for scrap higher.

Long product prices increased further in 2021 H1 as production was insufficient to meet the increase in demand, particularly from the construction sector. Chinese demand remained strong and a cancellation of the 13% VAT rebate on exports discouraged Chinese longs exports. With less exports from China and no production growth in the rest of the world, global supply remained tight, and prices found room to increase to the highest levels since 2008 in all regions except China, where extreme price volatility was observed.

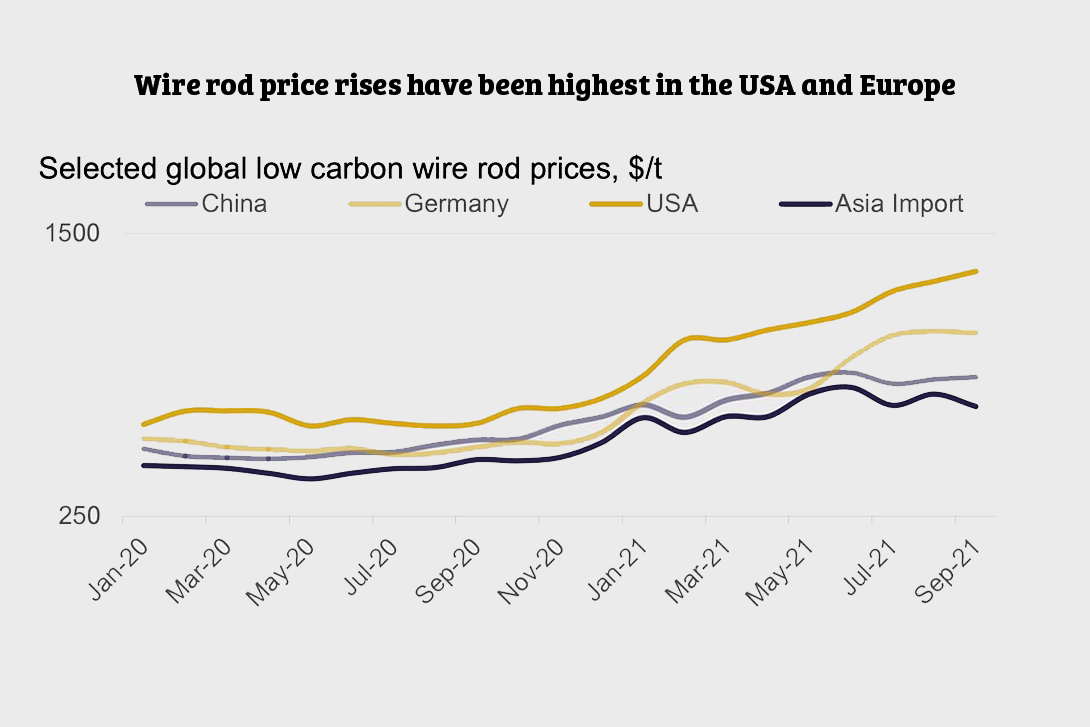

The supply deficit was most acute in Europe and the USA where safeguard duties are a limiting factor for imports, and this was reflected by even higher market prices. By September 2021, low carbon wire rod prices in Europe were close to 1.5 times those in Asia whilst US prices were close to two times Asian prices. Prices in western markets detached from their long-term relationship with cost.

High prices won’t last forever

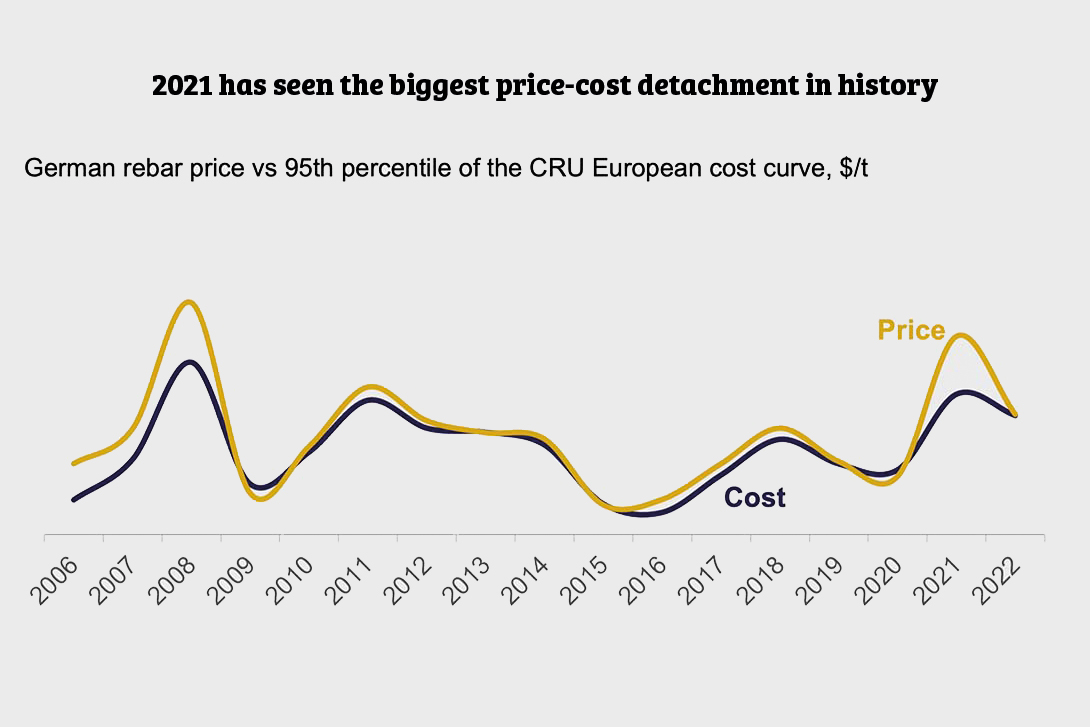

The high prices observed in 2021 are a once in a decade phenomenon. Although costs increased, prices increased much further. The Covid-19 recovery has resulted in the biggest long products price cost detachment in history. The last large price cost detachment for long products was in the period prior to the GFC in 2008. At a global level it is unlikely to be repeated for a long time.

High energy prices mean higher steelmaking costs

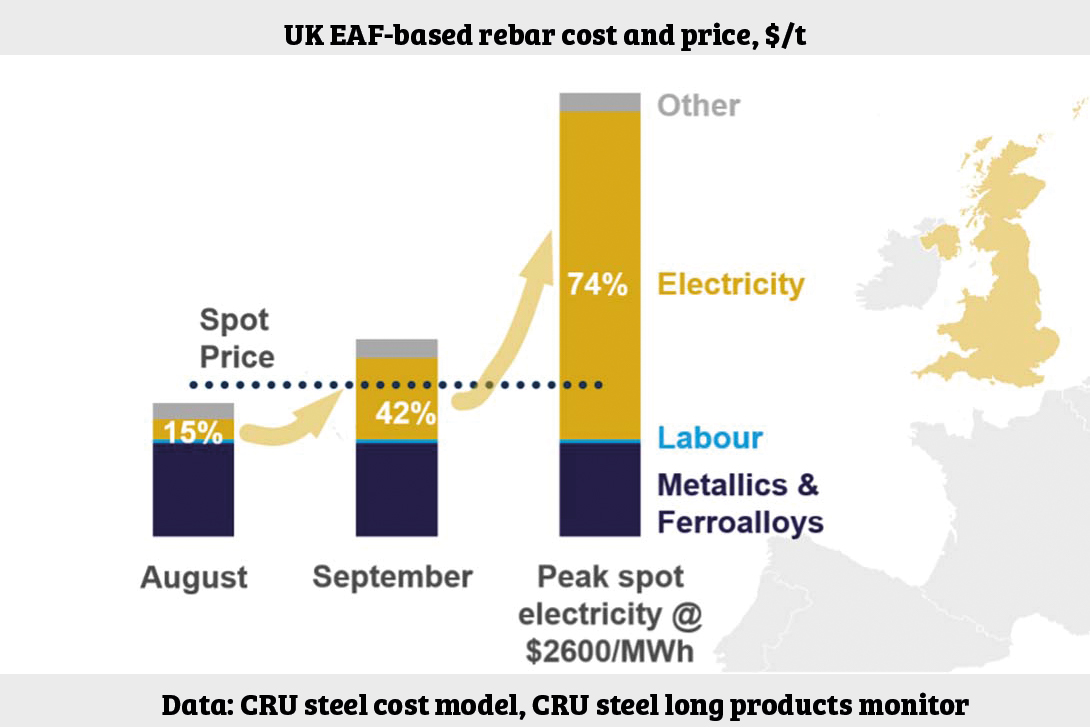

Although we expect prices to return to their relationship with cost, energy prices have pushed that cost floor higher. The rise in electricity prices in Europe is now affecting European steel producers’ costs. The impact varies depending on the steelmaking technology and country.

Electric arc furnace producers are affected more than blast furnace producers as they use more purchased electricity. In Europe, nearly all EAF producers serve the long products market, including many wire rod producers.

After a year of strong margins, some have turned lossmaking and have even idled production. For some the party is over.

www.crugroup.com

About CRU Group

CRU’s reputation with customers across mining, metals and fertilisers is for integrity, reliability, independence and authority. Its insights are built on a twin commitment to quality primary research and robust, transparent methodologies. CRU invests in a global team of analysts, the key to gaining a real understanding of critical hard to reach markets such as China. It strives to provide customers with the best service and closest contact – flexible, personal, responsive.

CRU have regular and specialised coverage of more than 50 commodity markets.

CRU Monitor products each provide a short-term, market analysis and prices service across a range of steel, bulk and non-ferrous commodity markets. Market Outlook products each provide a medium term market analysis service across a range of mining, metals and fertiliser commodity markets.

Having spent a decade in the fastener industry experiencing every facet – from steel mills, fastener manufacturers, wholesalers, distributors, as well as machinery builders and plating + coating companies, Claire has developed an in-depth knowledge of all things fasteners.

Alongside visiting numerous companies, exhibitions and conferences around the world, Claire has also interviewed high profile figures – focusing on key topics impacting the sector and making sure readers stay up to date with the latest developments within the industry.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.